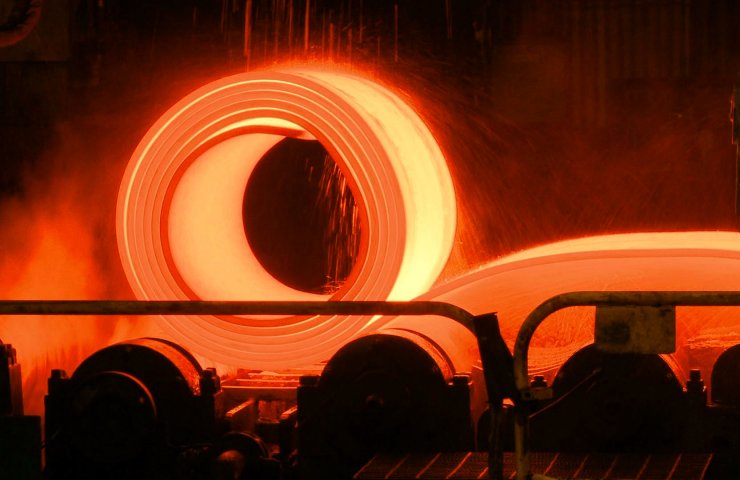

Everyone is asking the same question: what is happening in the US steel market? "Bloated", "too hot" are just a few of the phrases coiled steel buyers use to describe the current market. Unsurprisingly, steel prices have skyrocketed since summer. The market collapsed to almost zero at the beginning of the Covid-19 pandemic and only began to emerge from it in August.

Sentiment is always the driving force behind every industry, let alone the steel industry. During the initial outbreak of the virus, investors ditched off-the-shelf projects and buyers collectively tried, in some cases unsuccessfully, to cancel orders from steel mills or chose not to place any orders. Mills and steel mills were forced to cut production due to deteriorating demand forecasts.

Yes, hindsight is an exact science, but markets have become inevitably cyclical. After all, they change direction, including during periods that, to put it cliche, are unprecedented. What has been happening since August is no exception.

Steel buyers in the US have in many cases realized too late that when demand falls, there will always be a rebirth sooner or later. Responding too slowly to market movements can often adversely affect buying patterns, stock levels and ultimately profits.

On the other hand, those who understood their forecasting models and what factors contributed to the downward cycle probably got out of this situation with much higher earnings.

Demand exceeds supply

Steel producers are constantly comparing their production with the level of market demand, but it often happens that buyers placing orders at the mills dictate the price themselves. However, the refusal to place orders will directly reduce the production capacity of the steel mills, which will ultimately reduce the supply enough for the pricing pendulum to return to the producers' favor.

Note that capacity utilization in the US was 80.7% at the end of October 2019, but averaged only 55% between April and August 2020. At present, it does not exceed 67.9%, which is certainly much higher than the spring-summer level, but still significantly lower than normal indicators. It is clear that demand recovered faster than supply.

Although the upward correction may continue for some time, it will not last forever. Markets may take some time to calm down after extreme events such as the coronavirus pandemic, and the market is no different.

When mills return to more than 80% capacity utilization, we can assume that the steel industry is back to some degree of normality. But even when that time does come, don't expect price volatility to disappear.