The trader believes that the local British rebar manufacturer and the authorities were informed about the supply of Vietnamese materials that he intended to import, just at the moment when the revision of this material was announced for developing countries.

On November 10, the British Trade Office announced the launch of an investigation into Vietnam's exemption from existing protective measures at the request of 7 Steel, as they exceeded the World Trade Organization threshold of 3 pieces and entered into force.

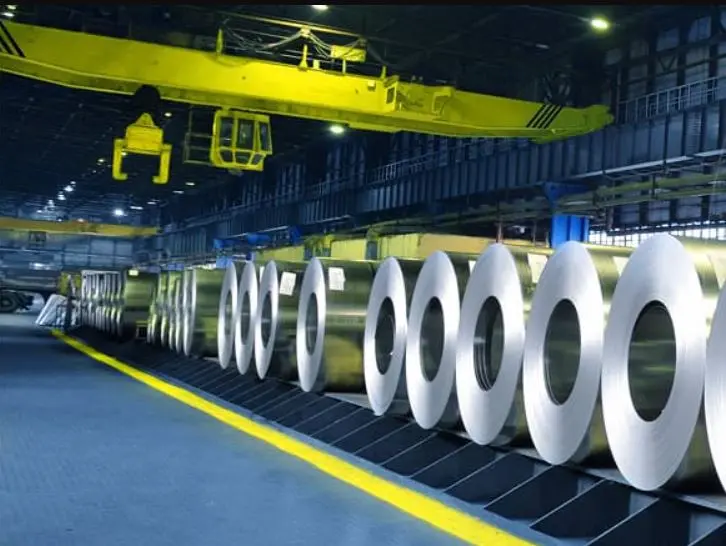

In July, a London-based trader delivered a cargo of Vietnamese rebar weighing 21,184 tons to the UK. Although this is the first shipment of Vietnamese raw materials to the UK since 1991, between January 2024 and August 2025, Vietnam's share of imports was 5.5%, excluding volumes from the EU. Including imports from the EU, since January 2024, the volume of supplies has amounted to 3.1%, which is slightly higher than the WTO threshold.

"Exemption from the status of a developing country does not meet the set goal. Vietnam's steel industry is significantly larger than the UK's, and it can supply huge amounts of steel to the UK. They will clearly exceed the 3% threshold, and by the time the quota is changed, the damage to the domestic industry will be done," said Peter Brennan, UK Steel's director of trade and economic policy, in an interview with Argus

The trader said that this was confirmed on October 24, the company concluded a deal with a Vietnamese factory and negotiated with the southern port about the ship's entry. In its complaint to TRA dated October 21, 7 Steel said: "We also understand that an additional large shipment from Vietnam is currently en route and is expected to arrive at UK ports soon." Apart from the July shipment, which left Vietnam in April, no other Vietnamese cargo was sold to the UK.

The trader cancelled his cargo because he could not risk paying 25% duties. British manufacturers say they have limited opportunities to purchase imported fittings, given the fact that the domestic manufacturer owns about half of the secondary market, and sustainability criteria — especially for public infrastructure — further reduce the range of their suppliers. The situation was further complicated by the introduction of restrictions in July.

Since January, shipments from the EU have accounted for more than 40% of imports, mainly from Portugal. Turkey is the largest supplier, accounting for almost a third of imports, followed by Algeria (16%). The share of Egypt, which is included in the remaining quota along with Algeria, has been about 5% since January 2024.

"It is cheaper to export scrap metal from Wales to Turkey, produce rebar in Turkey and ship it back to the UK,