Tata Steel, the largest Indian importer of Russian coal in the first quarter of this year, will stop buying, citing the Russian invasion of Ukraine has made these supplies more risky.

A Mumbai-based company pointed to "uncertainty" in Russian coal supplies, which traders and brokers say India increased purchases ahead of the war because competing Australian coal shipments had become too expensive.

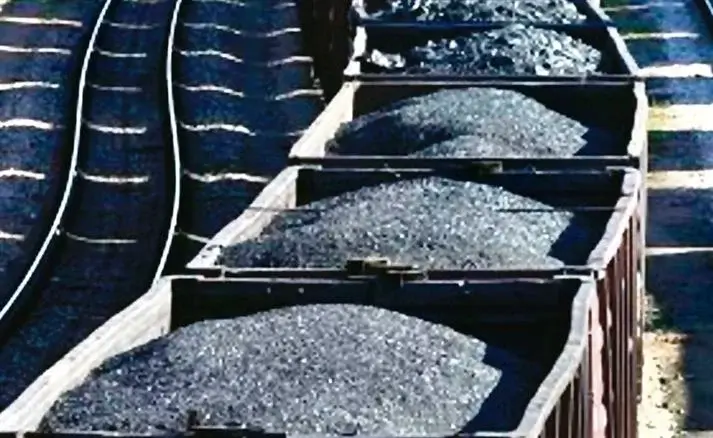

According to data provider CoalMint, Tata Steel imported 617,000 tons of Russian coal in the first three months of the year and received 246,000 tons last month. These orders were made before the start of the military special operation of the Russian Federation in Ukraine.

"In order to ensure business continuity, we have found alternative sources of raw materials, as transactions with Russian suppliers and bankers are currently subject to a lot of uncertainties due to international sanctions imposed against Russia" - quotes Tata Steel representative American edition of the Financial Times .

Despite the need to increase supplies, Russian exports, which take about a month to reach India, slowed to 420,000 tons in March and are forecast to fall to 124,000 tons in April from a recent peak of 1.1 million tons in February.

While demand for Russian coal is likely to increase, analysts say potential payment problems associated with international sanctions and the high cost of transporting goods over long distances are limiting purchases.

“The question is not self-sanctions, but whether Indian buyers can financially pay for coal with Russian counterparties due to economic sanctions,” said Matthew Boyle, Kpler’s lead bulks analyst.

Although Russia and India have discussed local currency payment mechanisms that would circumvent sanctions regimes, no scheme has been made public.

India has emerged as the most eager buyer of displaced Russian oil to support its supplies ahead of peak summer demand. The finance and foreign ministers of India defended these purchases.

Russia's two largest export markets, the EU and Japan, have banned the use of Russian coal, while India and Russia signed an agreement last October to expand coking coal cooperation.

A spokesman for a bulk shipping company said Russia was offering 20 percent discounts on its coal, but shipping to India would be 10 to 12 percent of the total import value.

"There are speculations that India will receive some Russian coal at a discount," said Satyadeep Jain, an equity analyst at Mumbai-based mining, metals and cement firm Ambit Capital, but "we haven't seen any significant volumes of supply.