China's gross domestic product (GDP) growth fell to a 27-year low of 6.2% in April-June from 6.4% in the previous three months. The achieved figure is within the framework of the government's planned annual growth of 6 to 6.5 percent.

Beijing is trying to stimulate the economic environment with tax cuts, soft monetary policy and other measures, increasing the already significant government debt. The slowdown has raised expectations for further stimulus measures to support the economy, which could boost steel demand in infrastructure and housing.

GDP numbers were in line with analysts' expectations, but sparked speculation about further stimulus measures, especially with uncertainty about progress in US-China trade negotiations.

The pressure on the world's second largest economy is growing. The volume of China's foreign trade since the beginning of the year has decreased by two percent, and in June compared to the same month last year - even by four percent. At the same time, if the drop in exports was only 1.3 percent last month, then imports - 7.3 percent. This was mainly due to trade relations with the United States. June was the first month in which there were increased duties in both countries on large imports. As a result, exports from China to the United States fell by 7.8 percent in June, while imports from the United States fell by 31.4 percent.

It is the trade war with the United States that is the main reason for the slowdown in growth in China, analysts say. Despite the fact that US President Donald Trump and Chinese President Xi Jinping on the sidelines of the G20 summit announced the resumption of trade negotiations, the parties have not yet returned to a substantive conversation. Trump, at a meeting with Xi in Japan, also promised to refrain from imposing new duties.

Lack of progress in negotiations affects investor sentiment. The trade war is slowing growth not only in China, but also in the United States, and hurts the global environment. Slower economic growth in China and expected rate cuts from the US Federal Reserve have opened the door for further monetary easing to support growth in line with China's official growth target of 6-6.5% this year, Singapore-based DBS Bank said. .

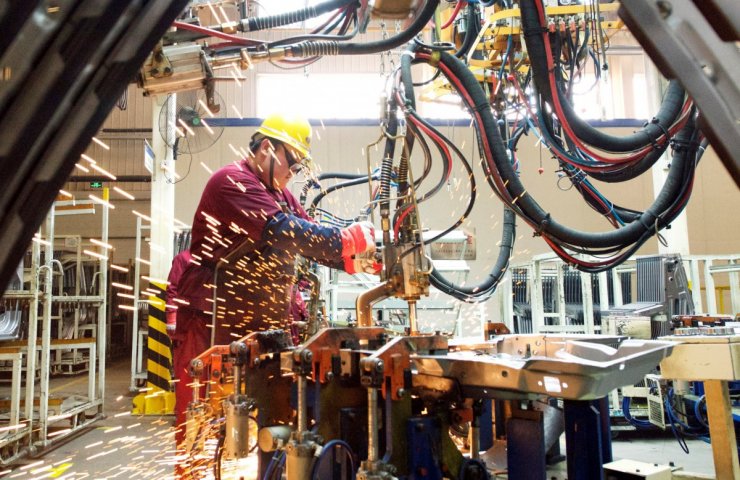

The current level of investment in sectors such as infrastructure and manufacturing is still "relatively low, " says China's National Bureau of Statistics, adding that more efforts should be made to "deepen reform, optimize the business environment and further stimulate market vitality ".

Any decrease in bank reserve ratios or lower interest rates on loans could be an incentive for the credit-sensitive real estate sector. China has cut its bank reserve ratio six times since January 2018, but has left its interest rate unchanged since 2016.

China's construction sector accounts for over 60% of steel consumption.

Real estate investment growth slowed for the second month in a row, with 10.9% year-on-year growth in Jan-June, but still higher than the 9.5% growth in 2018, which should support steel prices in the short term.

In January-June, the launch of new projects started at a rapid pace of 10.1% in terms of area. Real estate sales rose 1.8% year-on-year and 5.6% in yuan, indicating continued year-on-year real estate price increases should boost housing investment.

Industrial production growth increased to 6.3% in June compared to 5% in May. In terms of steel-consuming industries, car production declined by 2.5%. The production of railway, shipbuilding, aerospace and other vehicles grew by 14.5%, while the production of equipment grew by 2.6%.

The decline in the production and sales of cars has led to a decrease in prices and demand for flat products, and long-term sales have begun to bring more profit in the domestic market.

Growth in infrastructure investment remains sluggish, despite Beijing expanding the availability of funds for such projects by issuing special bonds and allowing projects to use these bonds as part of their capital to attract more bank loans.

In January-June, infrastructure growth was 4.1% in January-June compared to 4% in January-May.

As previously reported, Chinese metallurgical companies continued to increase steel production in June, mainly due to consistently high demand from the construction sector.