The lack of structural changes and investments caused Tata Steel UK's financial problems, not imports, the International Steel Trade Association (ISTA) said in a letter to government ministers dated February 10.

ISTA has denied Tata's claims that it may have to shut down production. some operations, if the import is not reduced.

"We welcome the continued open and constructive engagement of ministers and the Ministry of Business and Trade[DBT]with our associations; in this regard, we must express our serious concern that the threats posed by Tata prevent them from exerting undue influence on government decision-making in the way they appear to have done. when Secretary Reynolds[Jonathan]was pressured last summer," ISTA said.

Last year, Tata challenged the recommendation of the Consumer Protection Authority (TRA) to impose a 40% cap on other countries' quotas for hot-dip galvanized coils, which forced Reynolds to impose a 15% cap, which reduced shipments by months and forced buyers to duplicate orders and order them in Turkey.

The Government intends to make a statement on the new quota regime on or about April 1, which will take effect on July 1. According to some reports, Tata has proposed to introduce two quotas for each product: one for materials of European origin and one for the rest of the world.

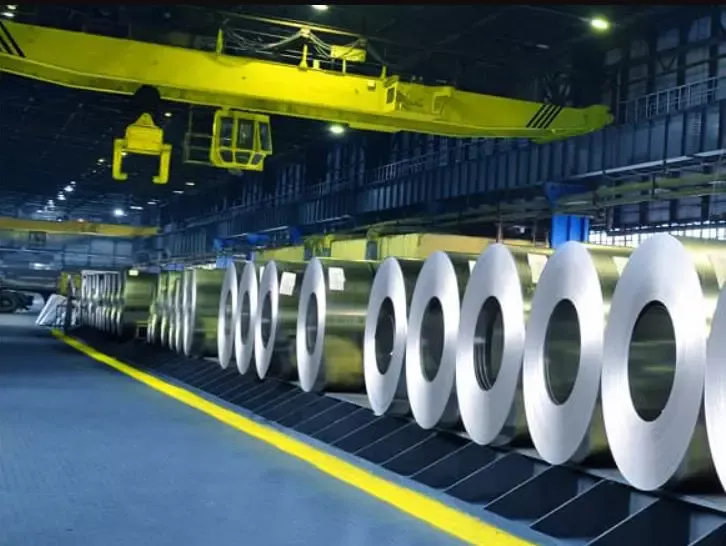

Imports from non-EU countries "have always played an important role in the British steel market, maintaining a share close to 35%," ISTA reports.

In the first 11 months of 2025, materials from third countries accounted for 25% of imports, while materials from the EU accounted for almost three quarters, compared with 62% in 2024. The largest supplier was the Netherlands, which supplied 355,168 tons, or almost 27% of the total volume of 1.32 million tons. France was the second largest supplier (almost 25%), while Germany and Belgium supplied 7% each. Dutch shipments were likely driven by Tata Ijmuiden's shipments to its UK subsidiary and were the most competitively priced in the EU, with an average shipping cost of 525 pounds per tonne (715 US dollars per tonne).

The cheapest supplier in January-November was Japan (458 pounds per ton), followed by Egypt (466 pounds per ton) and Taiwan (473 pounds per ton). Japanese materials were typically purchased at a larger quota of 1B for substantial processing later, while the Geneva-based trader mainly supplied Egyptian materials to a single service center in Midland.

The demand for striptease in the UK decreased from 5.3 million tons in 2018 to 3.6 million tons in 2025, while