Derivative rolled materials such as pipes and sheets are finally showing price increases in Southern and Western Europe, driven by recent price increases for rolled materials. However, consumption remains at the same level, and trade volumes are still limited.

The market is divided. Mining companies are optimistic about price increases and trade measures, while demand from end users and steel processors remains weak and shows no signs of recovery in the coming months.

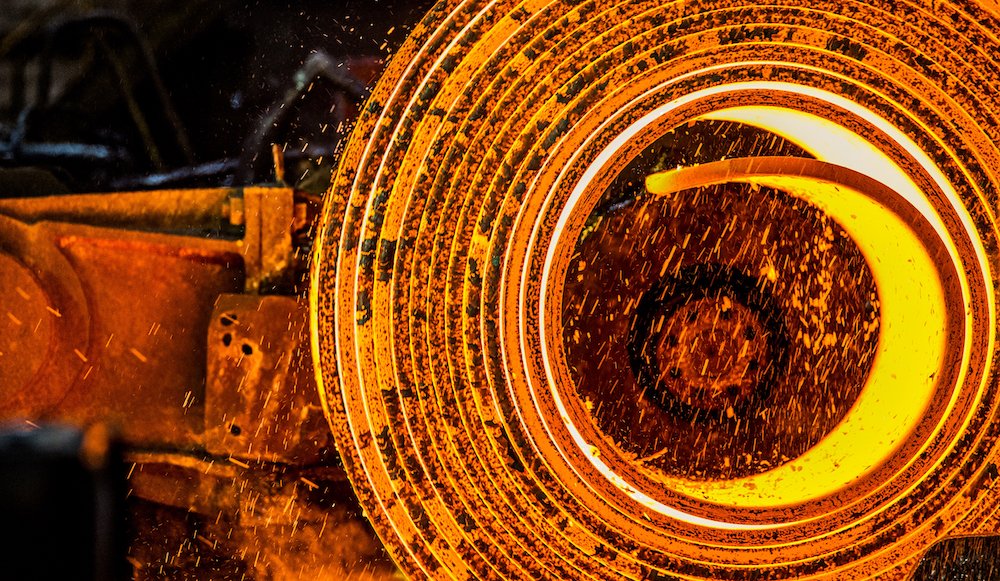

Despite the sharp increase in prices for pipes and rolled products, margins remain low and in some cases negative. The sharp rise in roll prices announced by manufacturers is a source of concern. One Northern European manufacturer has set a target of 700 euros per tonne (US$806 per tonne) for the base volume of hot-rolled coil shipments in the first quarter of 2026, which many consider excessive. Other producers are taking a more moderate position, offering prices for January at the level of 620-630 euros per ton.

The proposed increase may further deter buyers. The service centers inform Kallanish that they are already postponing the decision to purchase the coil. This is especially true for end users, such as crane manufacturers and steel processors supplying products to the agricultural sector, who are currently facing an economic downturn, production cuts and temporary layoffs.

Some steel processors believe that steel producers do not have a clear understanding of the extent of the decline in consumption in Europe. Key industries such as agriculture, heavy machinery and the automotive industry continue to experience difficulties and do not expect any improvements in the first half of 2026.

However, the demand for household appliances seems to have stabilized. A source at one of the companies reports stable sales in 2025 and for the first time does not expect a further decline in consumption in 2026. However, this does not mean that they expect any significant increase in the first half of next year.

While coil prices are rising, some traders are reportedly willing to cover the additional costs of CBAM. However, the German trader claims that he cannot do this.

Service centers and processing plants are receiving large volumes of materials previously ordered from Asia, and ports in Italy are reportedly overcrowded. Italian sources point to a shortage of cold-rolled coils, while importing hot-dip galvanized coils has become too expensive. As a result, CRC and HDG prices are rising sharply, and demand is now