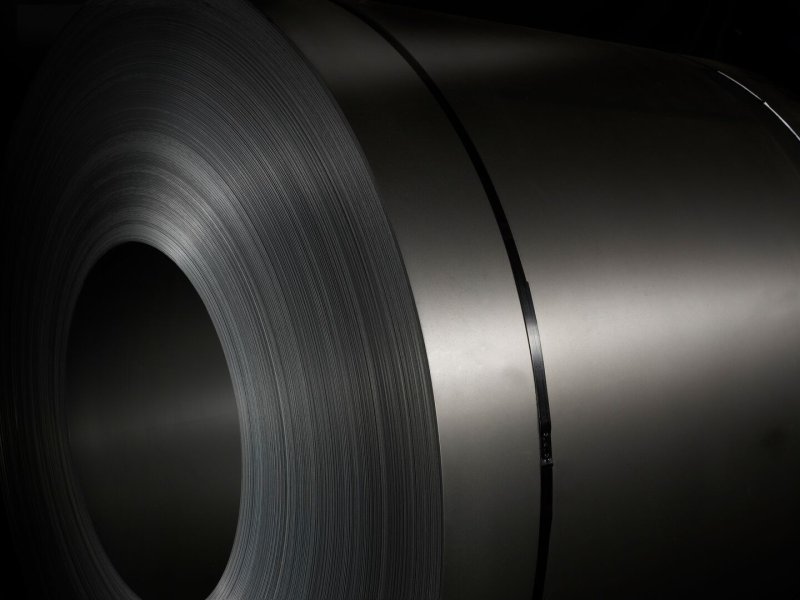

Prices for rolled metal in Europe rose in the week to October 17, as steel companies confirmed a revised supply level, meeting most of their obligations for the fourth quarter.

In Northwest Europe, offers for hot rolled steel (HRC) for delivery in 2025 were reported to be between 620 and 630 euros per tonne, although McCloskey sources in both the manufacturing and distribution segments still believe the sales level for the latest deals is between 570 and 590 euros. per ton, and expect near-long-term supply volumes, where possible– ranging from 580 to 600 euros per ton from the plant.

Forward offers for January were presented in the range from 630 to 650 euros per ton with delivery.

Factory sources reported strong sales at previous price levels following the latest round of supply price increases by steel companies, and some market participants believe that this latest increase in supply is unlikely to have an immediate impact on spot prices, instead contributing to the creation of more attractive conditions for steel producers during upcoming negotiations on long-term contracts.

Distributors expect the plants to make further attempts to increase along with the planned regulatory clarifications, namely the carbon limit adjustment mechanism (CBAM) calculated values and refinements to quotas for specific countries as part of the European Commission's proposed replacement of protective measures - and we do not yet consider higher supply levels realistic.

"We do not expect significant price increases in the near term, as there are more upcoming regulations that will give factories more reason to be optimistic," said the German distributor. "Everyone is monitoring inventory levels, transit imports and factory availability, as supply problems may arise if imports become impossible, but so far this has not led to massive transactions - buyers are not so desperate yet."

CBAM is already having a major depressive effect on import competitiveness ahead of the January budget coming into effect, as the uncertain financial implications for permits for 2026 result in importers being exposed to uncertain costs beyond reasonable acceptable risks. Existing import restrictions may then be strengthened as a result of the European Commission's proposed review of steel protection measures.

"Importers did expect some tightening and therefore bought large volumes of imports during the summer, but this is not even close to easing the actual level of import restrictions, which