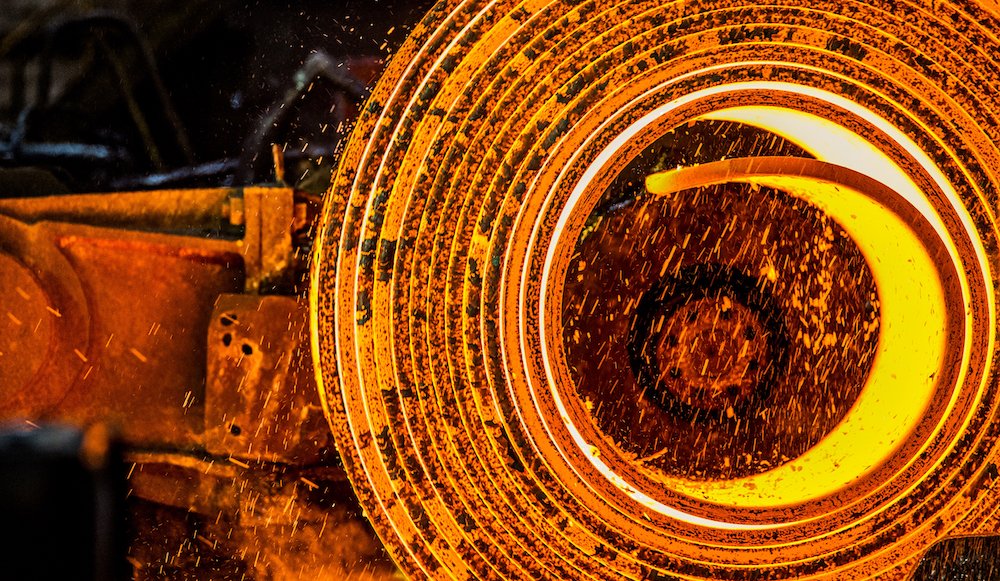

On Tuesday, January 20, hot-rolled steel prices in Europe remained generally stable, with limited import availability considered the main reason for the recent increase. Meanwhile, ArcelorMittal surprised the market with a new price increase, Fastmarkets reported.

European manufacturers could still offer March shipments of HRC, but supplies were running low, sources said.

It was reported that offers from integrated plants amounted to about 650-670 euros (755-778 dollars) per ton from the plant, while transaction prices still did not exceed 630-640 euros per ton from the plant in Germany and the Benelux countries.

ArcelorMittal announced new supply offers in April at a price of 700 euros per base tonne, but according to buyers, this price remains "above the market level."

A customer source confirmed that suppliers expected even higher prices for shipments in the second quarter, given expectations of increasingly limited supplies of imported steel due to both the Carbon Emissions Control Mechanism (CBAM) and the impending introduction of new safeguards.

"New protective measures are likely to be introduced after the expiration of the old system, that is, on July 1. This means that even if someone risks purchasing new imported goods under the CBAM regime, they will have to make sure that the materials arrive in Europe before the end of the second quarter," said a customer source.

In October 2025, the European Commission proposed a radical reform of its guarantees for steel imports, proposing to reduce duty-free quotas by about 47% and impose high 50% ad valorem duties on any volumes exceeding the new threshold.

Although the total quota volumes have been made public, it is still unclear how these volumes will be distributed, and the quota volumes for specific countries have not yet been made public.

"New imported goods are completely absent from the market because there is too much uncertainty about their cost and availability," said the second buyer. "Thus, we see a growing dependence on European factories."

The source also noted that European suppliers are in no hurry to increase production volumes in order to fill the gap created by imports.

"An increase in steel production would mean the need to buy more carbon credits (carbon EUA[European Union Allowance]), which are becoming more expensive. It makes sense to keep the market afloat[the HRC]," said a third buyer.

The daily price index for Fastmarkets hot-rolled steel for domestic consumption in Northern Europe amounted to 640.75 euros per ton on January 20, an increase of 0.12 euros per ton from 640.63 euros per ton.