American steelmakers are benefiting from President Donald Trump's proposal to strengthen the domestic steel sector by reinstating 25% Section 232 tariffs on all steel imports.

Its stated goal is to increase domestic investment, reduce imports, and increase steelmaking capacity utilization to 80%. After the U.

S. Census Bureau recently released its quarterly financial report on the United States manufacturing sector, revealing the current state of the steel sector, MEPs reviewed the prospects for American steel companies.

Steel companies are regaining their positions after the peak of profits after the pandemic

Despite a difficult year in 2024, the U.

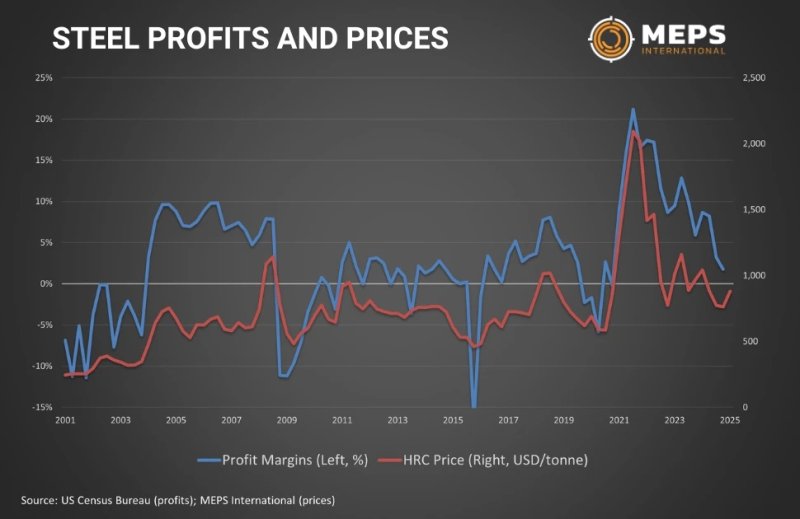

S. steel sector remains financially stable. Over the past few years, the industry has faced extraordinary price fluctuations. Steel prices have soared to record highs due to supply chain disruptions during the Covid-19 pandemic, allowing the industry to benefit from high profitability. From 2001 to 2019, the average rate of return (income before taxes divided by revenue) in this sector was only 1.3%. In contrast, profitability averaged 13% between 2021 and 2023, peaking at 21.2% in the third quarter of 2021.

Since reaching this peak, profitability has steadily declined. By the fourth quarter of 2024, the total profitability of the industry was 1.8%. This is slightly higher than the average for 19 years before the pandemic, but much lower than the highs of the pandemic period. The decline in steel prices and demand last year was largely responsible for this decline.

However, high profits in recent years have allowed steel companies to build cash reserves and invest in production facilities without significantly increasing long-term debt. As of the fourth quarter of 2024, the industry had almost $10 billion in cash, which is below the level of the pandemic era, but still significantly exceeds the norms that existed before the pandemic. At the same time, the share of cash in assets was 5.5%, which is lower than 9.1% in mid-2023, but higher than the average for 2001-2019 of 4.4%.

Despite significant investments in new facilities, U.

S. steel companies have maintained relatively low levels of long-term debt. As of the fourth quarter of 2024, the industry's long-term debt-to-equity ratio was only 0.308, slightly higher than the 24-year-old