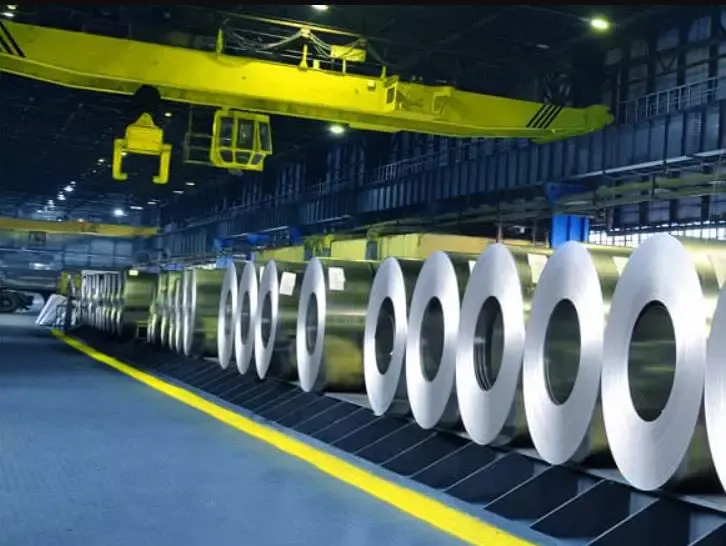

Brazilian hot rolled roll (HRC) prices have been declining throughout 2025 despite strong economic growth and steady demand in most sectors, with prices declining at the end of the year due to price competition between domestic and imported HRC.

Argus- The estimate of HRC cfr imports to Brazil decreased to $515-550 per metric ton (t) on December 11, compared with $535-555 per ton on January 2. Argus - the cost of HRC at the plant, according to the latest estimate, decreased to 3,600-3,900 rupees per ton (655.80-702.80 USD per ton) compared with 4,000-4,300 rupees per ton at the beginning of the year.

Brazilian factories have resisted pressure from a growing influx of imports at lower prices caused by an oversupply in China and have held prices steady for the first five months of this year.

But in June, factories went to lower prices, when the price range increased by as much as 38%. than the import. In July, buyers were able to conclude deals at prices below 3,400 rupees per ton, market participants told Argus.

Tightening protective measures around the world and anti-dumping measures against Chinese raw materials have helped redirect steel to countries with weaker trade protections, including Brazil.

Imports reached a record high of 6 million tons in the year to November, which is 7% more than in the same period last year, the Aço Brasil Chamber of Industry said. These volumes increased domestic production and apparent consumption — the sum of production and imports minus exports — by 2.5% to 24.8 million tons compared to November last year.

Service centers and trading companies took advantage of lower import prices to increase their inventories. The high inventory levels eventually affected demand and led to a decrease in supply.

In June, domestic and imported sellers were forced to lower prices to stimulate customer interest in an already oversaturated market. In July, import prices for HRC dropped below $500 per ton.

Sales increased

The Brazilian real strengthened by 14.2% against the dollar year-on-year by mid-December, which increased the competitiveness of imports in 2025. Imports provide another advantage besides pricing: lower financial costs for international trading firms.

Brazilian factories rarely operate on credit, and even if they did, Brazil's borrowing costs reached their highest level in 20 years in 2025.

The target interest rate in Brazil is 15%, which has led to higher commercial lending rates and reduced end-user demand, but not enough to significantly reduce steel consumption.

Despite the growing import flows, sales in the domestic market