Growing concerns about China's industrial surplus flooding the European Union with cheap products, especially electric vehicles, are opening a new front in the West's trade war with Beijing, which began with Washington's import tariffs in 2018.

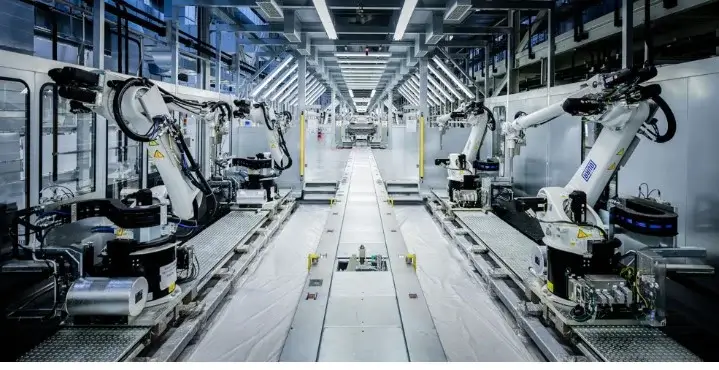

Chinese investment in electric vehicles sets a new record

EngineeringChina could produce 10 million more vehicles per year, equivalent to two-thirds of all North American production in 2022.

Consultancy firm Automobility estimates that China could produce 10 million surplus vehicles a year, equivalent to two-thirds of all North American production in 2022.

Brussels' trade policy is now also becoming more defensive towards China. In September, the 27-member trade bloc launched an investigation into whether Chinese automakers are benefiting unfairly from government subsidies. And in December, the White House unveiled plans to exclude China from its battery supply chain.

“These regulatory dynamics have spurred increased investment by Chinese manufacturers, who understand that an export-only strategy could cause serious political rollbacks in host economies and deprive them of lucrative markets,” the research organization said.

The report said South Korea and Morocco would particularly benefit as both countries support a free trade agreement (FTA) with the US, terms which Chinese producers could use to circumvent some of the Biden administration's restrictions on critical minerals mined in China. and battery components due to preferential sourcing rules for FTA partners.

“Chinese battery makers are bringing more supply chain participants into their overseas expansion, likely in response to growing market demand and pressure to refocus,” said the Rhodium Group.

The slowdown in the growth of the world's second-largest economy's own market for electric vehicles has also prompted Chinese manufacturers to increase their investments abroad. At the same time, automakers in the EU and US want battery makers to set up workshops near their factories to reduce transport costs and prevent supply chain disruptions, the report says.

But Chinese policymakers will have to tread a delicate line tightrope, the authors warn, to avoid “reverse technology transfer,” given China's relative advantage in the sector and the overseas operations of Chinese manufacturers threatening the profitability of domestic EV and battery factories. Policymakers believe the industry is key to preventing structural economic decline.

“As in other advanced economies, we may see diverging interests between companies and the government in China as companies seek to increase their revenues and profit from overseas investment while the government tries to maintain domestic investment,” the report said.

Rhodium is a New York-based research group known for its research in China.