The corruption and market manipulation lawsuit against Glencore Plc involves allegations of the conduct of two former executives who were in the trading house's inner circle for more than a decade and left as billionaires.

The US government has not filed any charges against Glencore's top executives in the massive Glencore case that the company pleaded guilty to this week. But in legal documents on Tuesday, the US said two former Glencore executives, one identified as the "global head of the oil group" and the other as a Greek-British citizen who was a "senior executive" in the copper and zinc division, were personally involved in corruption.

Based on the description, these men can be identified as Alex Beard, former head of Glencore's oil division, and Telis Mistakidis, former head of copper, respectively.

The documents, which Glencore in one case accepted as true and in another agreed not to deny as part of its guilty plea, say that the widespread and enduring culture of bribery was not limited to local middlemen or scammers, but perpetuated some of the most senior executives companies. Both men worked at Glencore for decades and were among former chief executive Ivan Glasenberg's closest aides until they left about three years ago.

A number of anti-corruption investigations have plagued the commodity trading industry for years, but have hardly touched the industry's top leaders. This is the first time in decades that the highest echelons of the trading industry have been publicly called out by US regulators.

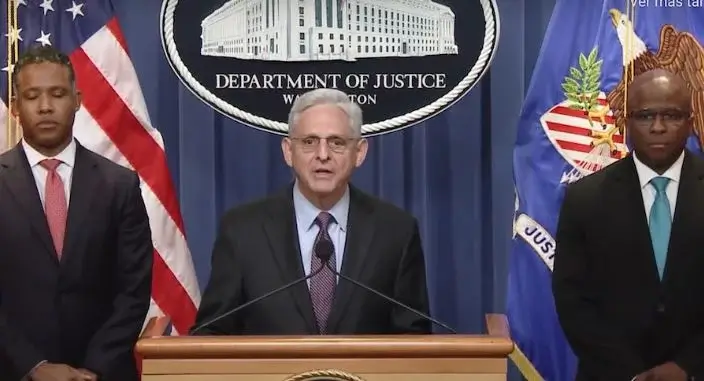

While U.S. Attorney General Merrick Garland said on Tuesday that holding individuals accountable was a priority in the Glencore case and in general, the U.S. has only secured guilty pleas from two former mid-level Glencore traders, Anthony Stimler and Emilio Heredia.

But in legal filings filed by the Justice Department and the Commodity Futures Trading Commission, the US has filed charges against a number of other Glencore traders and executives, including Beard and Mistakidis.

“Glencore’s manipulative, fraudulent and corrupt behavior involved traders and other personnel across its entire oil trading group, including senior traders, department heads and controllers up to and including the global head of the oil group,” the CFTC said in the order. about his settlement with Glencore. The Company did not acknowledge or refute the findings and conclusions in the CFTC order.

Bird was the head of the oil company Glencore in the study period from 2007 to 2018.

The British trader worked for BP Plc before joining Glencore in 1995 and becoming Head of Oil in February 2007. Known for his acumen in Russian oil trading, he left the company in 2019 and has an estimated net worth of around £1.5bn. $1.9 billion) on the latest Sunday Times rich list.

In a separate statement of facts, which Glencore found "true and correct" as part of its guilty plea, the Department of Justice referred to the conduct of several Glencore executives without naming them.

At a press conference on Tuesday, Kenneth Polite, Assistant U.S. Attorney General, stressed the admission of guilt by Stimler and Heredia.

He added: “These are difficult cases, especially when we have global partners. Where people may be lying outside the United States, we coordinate with our law enforcement partners around the world to ensure these people are held accountable wherever they are.”