The Board of Directors of NLMK (LSE: NLMK; MOEX: NLMK), an international metallurgical company, has approved the Company's Sustainable Development Policy (hereinafter the Policy).

The Policy defines the principles, goals and objectives of NLMK Group in the field of sustainable development, as well as the mechanism for managing the relevant agenda at the level of NLMK's Board of Directors. In particular, the Strategic Planning Committee of the Board of Directors is entrusted with the function of defining the company's goals and strategy in the field of minimizing environmental impact, including greenhouse gas emissions, and considering and approving the corresponding investment program. The Audit Committee of the Board of Directors will monitor the completeness of disclosure of information in the field of sustainable development.

The Board of Directors approved the relevant amendments to the regulations on the committees and made a decision to include in the agenda of the extraordinary general meeting of NLMK shareholders the approval of the regulations on the Board of Directors in a new version.

Leadership in sustainable development and safety is one of the four main goals of NLMK Group's Strategy 2022. The implemented changes will contribute to the successful achievement of this goal. The changes are in line with the best international practices, stakeholder requirements and confirm NLMK Group's commitment to the principles and goals of the UN Global Compact, to which the company is a party.

Information about NLMK Group

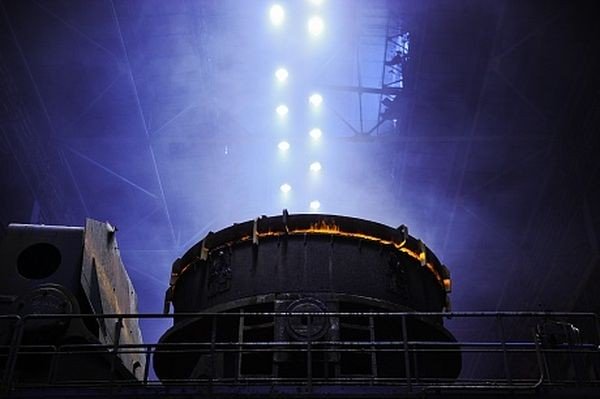

NLMK Group is a vertically integrated steel company, the largest in Russia and one of the most efficient steel producers in the world.

NLMK Group's metal products are used in a variety of industries, from construction and mechanical engineering to power equipment and offshore wind turbines.

NLMK's production assets are located in Russia, Europe and the United States. The company's steel production capacity exceeds 17 million tons per year.

NLMK demonstrates high cost competitiveness among global manufacturers, the company's profitability is one of the highest in the industry. The company's revenue for 2018 was $ 12 billion, EBITDA - $ 3.6 billion. The Net Debt /EBITDA ratio was 0.25x. The company has investment grade credit ratings from S&P, Moody’s, Fitch and Expert RA.