At the same time, the company believes that the adverse impact of the high key interest rate on demand will continue.

Illustrative photo: MMK.

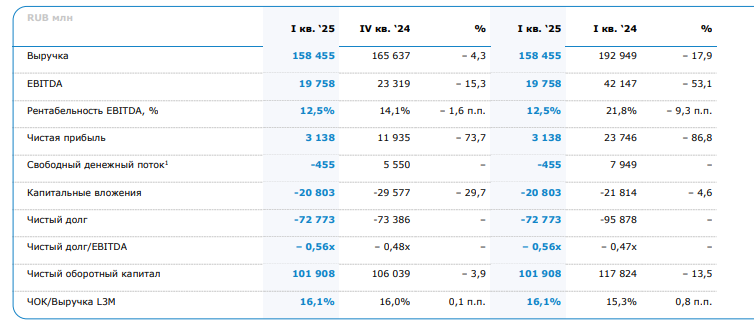

MMK Group's revenue for the first quarter of 2025 amounted to RUB 158,455 million, having decreased by 4.3% by the fourth quarter of 2024 due to a correction in average selling prices.

EBITDA (the company's earnings before taxes, interest on loans and depreciation — the cost of updating assets. ed.) amounted to 19,758 million rubles, a decrease of 15.3% compared to the fourth quarter of 2024. The EBITDA margin was 12.5%.

Net profit amounted to RUB 3,138 million, a decrease of 73.7% compared to the fourth quarter of 2024.

Free cash flow decreased relative to the fourth quarter of 2024 to -455 million rubles, mainly due to a decrease in sales profitability.

The main financial indicators of the MMK Group for the first quarter of 2025. Source: Magnitogorsk Iron and Steel Works.

MMK's capital investments for the first quarter of 2025 amounted to 20.8 billion rubles, having decreased by 29.7% compared to the fourth quarter of 2024, due to the schedule for the implementation of investment projects within the framework of the Group's development strategy, according to MMK's financial report for the first quarter of 2025. Compared to the same period last year, capital investments decreased by 4.6%.